Modern man cannot imagine his life without money. You use them to pay for various goods and services, lend money and borrow money. By the number and denomination of banknotes, you evaluate the work done or the service provided.

Money can be paper, metal, or even virtual. By itselves, they cost little, but the presence of a large amount of money allows a person to exchange it for travel, jewelry, food and many other benefits necessary for him.

One consider money to be evil that spoils people, while others see the meaning of their life in their earnings. Let's try to find a generalized definition of this concept.

- What is Money

- Functions of Money

- Types of Money

- How Much Money in the World

- History of Money

- USA Money

What is Money

Money is a measure of the value of any good or service rendered. In fact, this is the same product that can be exchanged for any other product. It emerged in the course of an exchange or barter transactions. The main task of money is to express the value of various goods, so that it is easier to compare it in exchange.

Earlier, the function of money was performed by various things. It could be not only objects, but also obligations and a set of things and obligations. In the modern world, the role of money is performed not so much by specific goods (precious metals, investment coins), as by the obligations of states and central banks in the form of banknotes.

By itselves, these pieces of paper do not represent value, but they are equivalent to a certain value of any product or service. This equivalent is indicated on the banknote itself.

Earlier, people in the bank for the accumulated gold were given such a receipt or, as they say now, a banknote.

In other dialects and languages, there are definitions similar in sound, for example, “tamga” among the Khazars, which means “brand”, “seal” or “danaka” among the ancient Greeks.

Each country has its own currency, but all of them, by tacit agreement, have the following qualities:

- Uniformity. Banknotes and coins are made from the same material. For example, in one country a coin of the same denomination cannot be produced simultaneously from wood and iron;

- Recognition. The design of the money should be memorable so that people can quickly find the right banknote and complete the exchange operation. Often on the money, each country depicts a famous person or landmark;

- Divisibility and integrability. Large denomination notes should be easily exchanged for smaller ones, while the total value of small denominations should correspond to the original large banknote;

- Durability. They must be made of durable material so that they do not wear out for a long time during use;

- Portability. Money should be light and small in size, their weight should not depend on the denomination;

- Security. Modern money is protected from counterfeiting by various holograms, watermarks, the use of special paper or ink.

Watch the video, which describes in detail in simple words what money is and how it works:

Functions of Money

If earlier for 5 beautiful shells you could buy only 5 coconuts or exchange them for 3 carved bowls, then with the development of society, the role of money has become more complicated, they began to perform significantly more functions and their role in society has expanded significantly. Against this background, professions and services began to appear, the existence of which simply doesn't make sense without money.

If money suddenly disappears, humanity in its economic development will be pushed back several centuries, and all because money now has a lot more functions. Let's consider them in more detail.

The Measure of Value

Any product or service has its own price, which is expressed in a certain amount of money. Also, money can be used to evaluate a person's labor. The more qualified and better a specialist is, the more he is valued in the labor market. The same applies to goods. The higher quality and more exclusive they are, the more expensive they are.

Means of Payment and Circulation

Money is paid for goods instantly or after a while, they can be borrowed or lent. Both the settlement for the goods and the promissory note have monetary value. Previously, the trade turnover was in the form of "goods-goods". After the commodity began to be valued in money, this scheme changed to “commodity-money-commodity”.

At the same time, money became not only a means of circulation and the most liquid commodity, but also greatly simplified trade relations for people, bringing them to a completely new level. Now you can sell products to other continents and get real money for it, and without delay, through a bank account.

Accumulator

Money that a person has not spent, he can collect and over time spend savings on new purchases.

Means for Interstate Payments

Not only ordinary people use money in their relationships, but entire states sell their own resources for money, and with the proceeds they buy goods that are not produced on their own territory. Similarly, economic relations are established between producers both within the country and between enterprises of different states.

Means for Determining the Social Status

In addition to the functions listed above, money can give a person a status in society. Their presence and quantity determines the quality of life. The more money a person has, the more goods he can buy for them and the higher his social status in the modern world.

Types of Money

From its inception to the present day, money has come a long and thorny path from cattle to virtual cryptocurrency and electronic funds. The development of trade relations affected not only the appearance of money and their functions, but also changed their essence in the process of evolution.

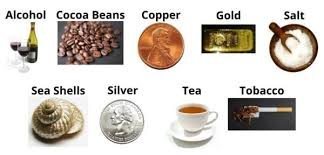

Commodity Money

This type of money is the real equivalent of a product. Its purchasing power is equal to the value of the given product. Initially, such money was basic necessities, then luxury goods, and later, bars of gold and silver.

The word "commodity" in translation from the Turkic means "cattle". Previously, the cattle could pay for necessary purchases. But not only cattle was accepted as payment, it was possible to pay with salt, furs, tools and other necessary items.

Over time, commodity money was transformed into metal coins, the nominal cost of which fully coincided with the value of the metal used in their manufacture.

Now any commodity exchanged by barter can be called commodity money. With this type of exchange, banknotes are not used, and the price of the goods is set by the participants in the exchange operation.

This type includes coins and banknotes issued for collectors on the occasion of the anniversary or the Olympics. They are sold in banks or collectors. These coins can be a good gift or investment. Over time, their price may rise, and it will be possible to sell them at a better rate.

Full-Value Money

This type includes any money, including gold, silver and copper coins, which face value coincides with their market price. For example, a 2 gram gold coin will cost the same as the market asking for 2 grams of gold.

!Such banknotes are not afraid of inflation, since the price of gold is always growing, which means that coins cannot depreciate.

The value of silver and copper coins fell several times in the entire history of the existence of high-grade money due to the discovery of new deposits of these metals. But these leaps were enough for the developed countries to switch to the "gold standard" and consider only natural gold coins to be valuable money. Industrial England was the first to come to this conviction.

In modern conditions, full-value money is issued in limited quantities in the form of collectible or commemorative coins.

This money is not suitable for general consumption for several reasons:

- Too expensive production;

- During long-term use, gold coins wear out, and with weight loss, their real value is lost;

- Due to the complexity of production, there will quickly be a shortage of coins in circulation, they will not be enough to pay for the constantly growing range of goods and services;

- Not all states can boast of having their own deposits of precious metals. These countries have to buy gold from other countries.

Non Full-Value Money

In fact, this is money that replaces full value. The production of such signs costs less than the denomination indicated on the outside of the coin or bill. So, the cost of one hundred dollar bill is only 4 cents.

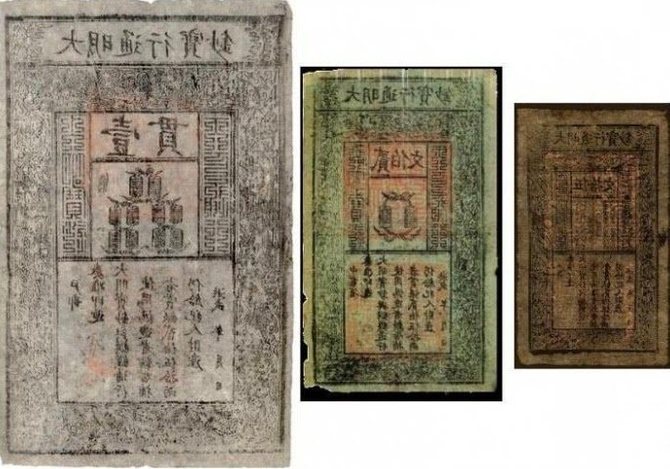

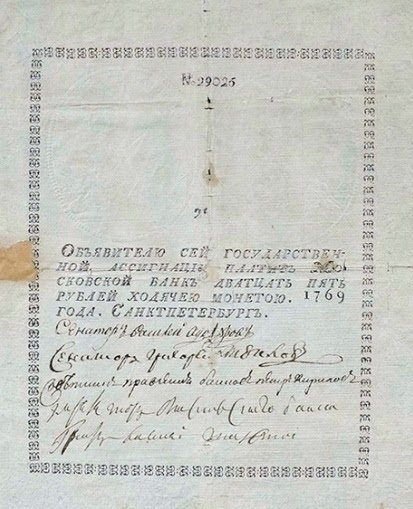

Non full-value money is divided into paper, metal and credit. The very first paper notes began to be printed in China, and in Russia, the production of paper notes began in 1769.

Allocate secured and unsecured non full value money.

Secured banknotes belonging to the category of full-value money are called secured, since, despite the absence of value, they allow them to be used for exchange for products or precious metals at face value. With the abolition of the "gold standard" this type of money has lost its relevance, so now only unsecured non full-value money is in use.

Unsecured inferior money is now more commonly known as fiat money.

Fiat Money

The nominal price of this means of payment is established and guaranteed by the state. All national currencies belong to fiat (fiduciary) money. They can be presented in the form of banknotes, coins or electronic and non-cash banknotes. This is the money that is familiar to the entire modern society.

Fiduciary money is not backed by precious metals, but only by the authority of the country, so there is always a risk of their depreciation during hyperinflation – this is precisely the main problem of their use.

Another reason that triggered hyperinflation in those years was the sharp decline in jobs. After the collapse of the USSR, the planned economy also collapsed, industrial plants began to close, and productivity declined. In the course of the reforms, huge capital was withdrawn from circulation, which made it rather difficult to create new economic relationships. Only manufacturers of competitive goods managed to survive.

There is also an opinion that the deficit of some groups of goods was created artificially. Enterprising traders simply hid their products until prices were liberalized. Many believe that after the collapse of the entire industry, it was actually possible to feed people and keep the state afloat only through colossal loans in the West and the sale of natural resources, which were at the disposal of the new government of reformers.

By the way, the reforms of the government at that time can be called “confiscatory”, since all actions were aimed at confiscating the excess money supply from the population that had settled in their pockets. And it was considered superfluous due to the lack of real provision of goods.

In 1991, the population was given only 3 days to exchange their savings in rubles for new banknotes of the current year of issue, and the maximum amount for exchange was only 500 rubles. All other savings were offered to be deposited in a savings account in the bank.

Similar exchanges were carried out in 1993, but this time the maximum exchange amount reached 100,000 rubles. Of course, not everyone had the opportunity to make an exchange in 3 days. Thus, all Soviet contributions were devalued.

The reform was supposed to withdraw the surplus money supply from people, but its result was a decline in production due to a lack of working capital. It was already difficult to switch to other economic relations, since such actions of the reformers provoked an acute distrust of citizens towards the Russian ruble, which at one point became an unnecessary piece of paper.

Electronic Money

These are virtual banknotes that can be used to pay for purchases and services received on the Internet.

Electronic funds can be fiat or non-fiat.

Fiat electronic banknotes are designated as the main currency of the country and are backed up at the state level. They are used in calculations on a par with paper bills. The most common form of such currency is bank cards. So, with electronic money that is stored on cards, you can pay for purchases in stores, orders in restaurants, etc.

An example of this type of money is Webmoney. The exchange rate in this payment system is approximately equal to the exchange rate of ordinary money, but within the payment service there is its own conversion rate for rubles, dollars and any other currency. It is important to note here that if the payment service suddenly disappears, users' savings will disappear along with it, since they are not backed up by government obligations.

Despite the risks of using electronic means of payment, for many it is a convenient method of payment, which is actively used by Internet resources, freelancers, etc.

Such money is stored in virtual electronic wallets, and you can use it to pay for goods, transport services, fines, taxes, etc. Electronic money is used to pay salaries, it can be withdrawn to bank cards and transferred to other virtual wallets. If you transfer electronic currency to a card, then it can be withdrawn from an ATM, thereby converting it into real paper money.

The number of electronic payment services is growing rapidly every year. Today, in addition to WebMoney, the most popular are PayPal.

Digital Money (Cryptocurrency)

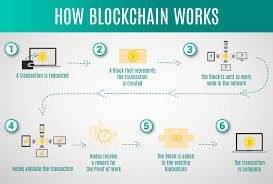

This is one of the varieties of electronic currency, but unlike WebMoney and other similar services, cryptocurrency does not have any intermediaries who need to pay commissions for transactions.

If money is transferred from one WebMoney wallet to another, the user pays additional costs to the system, as well as when using Visa / MasterCard cards, a commission is paid to the bank.

Cryptocurrencies are not pegged to the dollar or precious metals. It is not controlled by any state body, its course is not influenced by the central banks that issue money. Cryptocurrency is created by solving complex mathematical problems. And the main feature of some cryptocurrencies is complete anonymity.

For many politicians, such freedom and lack of control is a dangerous signal, they are trying to limit the distribution of digital coins so that there is no threat to ordinary paper money.

Bitcoin became the first cryptocurrency in the world. The history of its development began 12 years ago, when someone named Satoshi Nakamoto published a document on the network describing a new cryptocurrency. The emergence of bitcoin has raised a lot of hype around itself. Someone believed that the future lies behind him, while others openly ridiculed him.

Since the advent of the first cryptocurrency, this industry has gained so much momentum that the number of cryptocurrencies now exceeds 1000 varieties, and the field of application of digital money and blockchain technology is growing every day.

Bankers are worried that at this rate, cryptocurrency will be able to revolutionize the financial system of countries and supplant banks.

Credit Money

These are funds that the bank issues to the client for a certain time. For using the loan, in addition to the borrowed amount, you will need to return an additional interest. The basis of credit funds is bank deposits, that is, the money that other customers have entrusted to the bank for safekeeping.

Loans are issued not only to individuals, but also to companies. Even states borrow money at interest. A loan is taken when there is a need to quickly make a purchase, but there is not enough amount for this. Refund terms and additional fees are negotiated before receiving a loan.

Banks can issue loans not only in the form of cash, but there are also targeted loans (for an apartment, car, renovation, business development, etc.). Large sums are usually issued on the security of existing or acquired property.

! In most cases, the bank requires a potential debtor to confirm that his income allows him to repay the loan within the agreed time frame.

For individuals, such confirmation is income statement, bank account statements and other similar documents.

External and Internal Money

In addition to all the listed types of money, there is also external and internal money.

Internal banknotes are created by commercial banks, and external ones are issued by the Central Bank.

This institution does not work with private clients. Individuals receive banking services through intermediaries – commercial banks. In the USSR, the State Bank was completely controlled by the state, and the Central Bank of the Russian Federation is a separate legal entity, over which not a single branch of government can influence.

Domestic money is both assets that depositors have given to the bank for saving and debt obligations for other users. Investors receive income for the fact that the bank uses their money, and those who borrowed money from the bank pay interest for their use.

The interest on loans issued by the bank is always higher than the percentage of income on deposits. The difference between the interest goes to the bank's profit. Thanks to such a cycle, production and its economy as a whole are developing in the state.

Internal money includes:

- Checks. This document confirms that the settlement was carried out by bank transfer. With a check, which bears the signature and seal of the account holder, you can come to a banking institution and demand to pay the amount specified in it. Based on this document, the bank debits the required amount from the personal account of the owner of the checkbook;

- Promotions. This is a type of securities that certifies that its owner has a part of a company. Joint stock companies can be open (OJSC) or closed (CJSC). OJSCs offer their shares at an open auction, and only those who invested money in the creation of an enterprise take part in the purchase of shares in CJSC;

- Bills and bonds. Both of these documents are issued instead of the borrowed amount, with one difference: the bill of exchange simply has to be returned on time, and the bonds must be repaid with interest. Bonds are issued by both enterprises and entire states.

External money includes fiat funds, foreign exchange, gold and silver bullion held by the Central Bank. The cash and deposits of the Central Bank are called the “monetary base”. The central bank controls the work of commercial banking structures and services government accounts.

Thanks to the Central Bank, it is possible to keep records of the entire amount of money in the hands of the population, to collect taxes, fines from their accounts, freeze funds in court proceedings, etc.

How Much Money in the World

Probably everyone has thought about this issue at least once. Really wondering how much money is minted and printed? And if you add electronic money to this, will the total amount change much?

! Let's start with the fact that the number of electronic means is almost 100 times higher than the circulation of paper money, which in the modern computerized world can already be considered a variant of the norm.

If we talk about national currencies, today there are more than 150 types of them, but the most popular and widespread are the euro (EUR), dollar (USD), Chinese yuan (CNY) and Japanese yen (JPY). The share of these currencies is 70% of the total turnover.

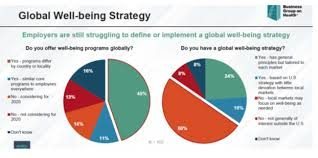

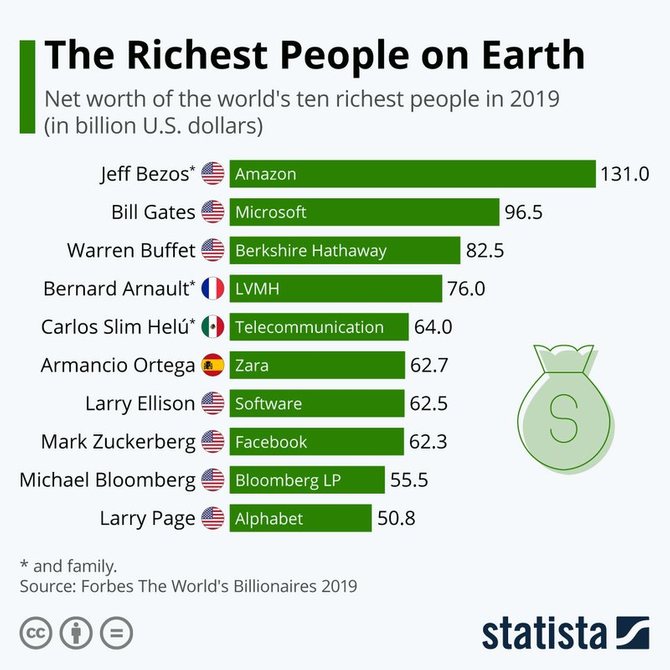

But real statistics assert that 80% of the earth's capital is in the hands of only 20% of people, the rest of the planet's inhabitants get only a small share of the total pie – about $ 2,500 per person.

For information, if you want to be richer than half of the world's population, it is enough to have an amount of $ 7,000, but to enter the TOP-1%, your income level must be at least $ 940,000.

It is interesting to note that at the moment, there are about 47 million dollar millionaires in the world, which is almost 1% of the adult population of the planet.

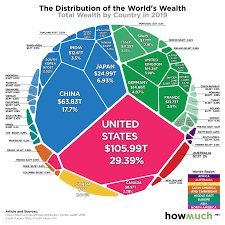

According to the same statistics, the bulk of the world's wealth as of 2019 is concentrated in the United States and China. Japan, Germany, England are a little lower in the ranking.

History of Money

The history of banknotes consists of 4 main stages:

- The emergence of money. Initially, their function is performed by various goods.

- The title of the world equivalent is assigned to gold.

- The title of the world equivalent is assigned to gold.

- Cash is gradually being squeezed out of circulation. Development of e-commerce.

If everything is clear with the last stage, we can observe it in our daily life, then we will try to understand the rest of the historical milestones in more detail.

Who Invented the Money

It is not known for certain who invented the money. Initially, the primitive tribes did without any money at all. If necessary, they simply exchanged a goat for a cow, or a tool for the skin of a killed animal.

But with the growth of the population, the number of consumers of the product also increased, and at the same time it became difficult to remember who, to whom and what was owed. That is why tribal people began to equate the debts of their fellow tribesmen with pebbles or seashells. So, at least, they calculated in Africa, China and India in the II millennium BC.

Different nationalities used various goods as money: on the territory of modern Germany they used cattle in calculations, in Mongolia – tea, Peru and Bolivia – they used pepper, in Kievan Rus – squirrel skins, and in Mexico – sugar and beans.

Such a calculation was possible in one small group of people, but for large associations it became necessary to come up with a more universal method of mutual settlements.

The times of the Roman Empire came, and metal came to replace natural exchange. People learned how to process it and mint coins from it. At first, iron, copper, bronze and other alloys were used, but such coins were short-lived, so over time they were supplanted by gold and silver.

Gold was first exchanged for a commodity. When making calculations, he was simply weighed. But over time, the task was simplified when they began to affix a stamp on the metal confirming its weight.

Others are sure that the king of Persia, Darius, can be considered the creator of the first gold coins. And recently, archaeologists have found even more ancient coins of an alloy of gold and silver, minted in the powerful state of Lydia, once located in Asia Minor.

Precious metals began to be used for minting coins for several reasons:

- Raw materials for them were rare and expensive, which means that it was easier to control the strategically important industry of minting coins;

- Gold coins could always be melted and used for their intended purpose;

- Trivial weighing could estimate the approximate value of a coin, even if a person sees it for the first time in his life;

- They did not deteriorate, did not deform over time;

- Have a stable value.

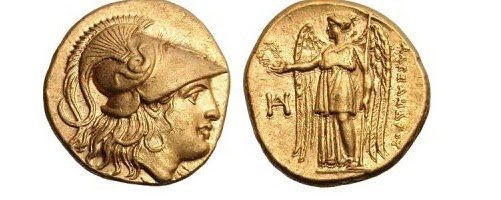

The great warrior Alexander the Great was called one of the main discoverers of the fashion for money design. When each Greek city minted its own coins, it created a single coin for the entire country. Money was issued from gold and silver, on the gold was the goddess Athena, and on the silver – Hercules in a lion's skin, which was eventually replaced by the image of Macedonian himself.

In Kievan Rus, coins began to be minted in the 9th-10th centuries, but due to the fact that there were no explored deposits of precious metals on its territory, gold and silver Arab and Byzantine coins were mainly in use.

Since the 11th century, copper and silver ingots have been used for internal circulation. The most popular were “hryvnias”. They were in the form of a 1 pound silver bar. Such money was very expensive, so it was often cut in half, each of these halves was called a “ruble” or “ruble hryvnia”.

How Did the Money Appear

Natural exchange, pebbles, shells and metal money have become inconvenient to use over time. They are heavy, cumbersome, and weighing, checking for cleanliness and other measurements during the calculation took a lot of time.

The practice was widely used when gold was given to the goldsmith for saving, who had a special storage room-safe. In such pantries, gold was stored for a fee, and in return, the master gave the depositor a receipt. Over time, they began to exchange goods for these receipts. These goldsmiths were the prototypes of modern banks.

Over time, the amount of gold reserves of the craftsmen increased, but no one was in a hurry to exchange them back for receipts, so the craftsmen began to issue receipts, not backed by gold, into circulation, giving loans to merchants and manufacturers. This is how the semblance of a modern banking system based on private reserves was born.

It is believed that the founders of banks were goldsmiths from England, but the invention of the first paper money is credited to the Chinese, who first invented paper, and then began to make bills out of it.

The first banknotes in Europe appeared in Holland after the Anglo-Spanish War. They were printed on pressed paper that was used to print the Bible. When the war ended, this money was removed from circulation.

Too many bills were issued and they eventually depreciated. Some had to be withdrawn from circulation.

In the Russian Empire, paper money appeared only in 1769 under Catherine II.

For a long time, both the population and the states were skeptical about paper money, giving preference to gold and silver coins.

It was especially difficult for paper money when the era of the gold standard came. It was opened by the Bank of England when it decided to freely and without restrictions convert the British pound into gold. The gold standard was introduced in many economically developed countries, including the United States and Russia. Since the introduction of the gold standard, it has been possible to exchange currencies against each other at a fixed rate of each of them in relation to gold.

Such a system increased the stability and reliability of national currencies, but it did not make it possible to print paper money in an amount sufficient for the country's economy. It was also difficult to maintain parity in the exchange rates of gold currencies, which eventually led to the victory of paper money.

In 1944, there was a final abandonment of the gold standard, since it turned out to be unprofitable for the war-torn countries, and since the 70s, the states began to switch to floating exchange rates.

Paper money was no longer tied to gold, effectively taking away the title of real money from it. From that moment on, gold became an exchange commodity, and money became a means of paying for goods and services.

!In the 21st century, mankind has entered the stage of active growth of information technologies, against the background of which a technological breakthrough has occurred in the field of finance.

Cashless payments, which exclude the physical transfer of bills from one person to another, have become very popular. Now all monetary transactions can be made using a bank card. Transfers and purchases can be made without leaving home, paying for a communal apartment in one click or buying transport tickets.

Despite such dramatic historical changes in the form of issuing money, their essence has practically not changed over the centuries. Money can be called anything that people are willing to accept as payment for a product or service.

See a short history of how money appeared and how it developed:

USA Money

There is no more recognizable currency in the world than the American dollar. It can be bought at a bank in any country, at an exchange office, it is freely convertible, they can pay for purchases in retail stores and over the Internet.

England had a strong army, a developed economy and many colonies scattered around the world, which was the main reason for the prevalence of the pound. The British traded actively, thereby strengthening the position of their national currency.

The primacy of the pound remained until 1944. It was in this year that the famous Bretton Woods conference took place, where representatives of all the strongest states on the planet agreed that the United States is the only state that the war has made even stronger, and the dollar is the only currency that can claim to be the main world currency.

There were several prerequisites for such a decision:

- In Europe, there were two bloody wars, many states suffered heavy losses, and their economies and agriculture were in complete decline. In such conditions, the British pound could no longer provide stability and guarantee reliability;

- There were no such destructive cataclysms on the territory of the United States as in Europe. Additionally, the Americans managed to improve their economic situation by supplying weapons and food to the belligerent countries. In the post-war period, America was actively developing the economy and raising the standard of living of the population, while Europe was just trying to get on its feet.

During the Bretton Woods Conference, the dollar was recognized as the only currency that has a fixed gold content. The issued paper notes could be exchanged for a gold equivalent at any time.For $ 35 you could get a triple ounce of gold.

The proposed system was well thought out and functioned successfully for 20 years.But the important factor was that the US had sufficient gold reserves to convert foreign dollars into gold.

Everything went downhill in 1965. The President of France, Charles de Gaulle, went to the US government with a request to exchange $ 750 million from the country's gold and foreign exchange reserves for gold. Then the reserves of France were deposit by 825 tons of pure gold. Representatives of Canada, Japan, Germany and other countries immediately followed de Gaulle's example.

US reserves declined sharply and the Bretton Woods system collapsed.

This period in the history of the United States was called the "Nixon shock". In 1971, as the dollar began to fall relentlessly, Richard Nixon unilaterally removed the dollar's peg to gold. In 1973 the fixed exchange system was replaced by the Jamaican system, which is based on the free conversion of currencies.

There are several reasons why the American dollar, despite the lack of guarantees, remains the world currency today:

- Over 60% of trading operations on the world market are carried out in dollars;

- In most countries, the gold and foreign exchange reserve consists of assets denominated in dollars;

- The United States has one of the largest and most developed economies in the world, providing the reliability and liquidity of its currency;

- Today there is no worthy alternative to the dollar, there is no currency that would be even more stable.

This state of affairs is convenient for many participants in the trading process in the global financial markets. They are satisfied with the fact that there is no need to change economic interstate policy and revise trade agreements. Therefore, for now, the dollar is holding its positions in the foreign exchange market, but the euro and the Chinese yuan are confidently beginning to step on it.