Rumors that Facebook is developing a blockchain and its own cryptocurrency Libra began back in 2018, but only in the middle of June 2019 the official presentation of the project took place. It was about launching a “global monetary and financial infrastructure” for 1.7 billion people in those countries where banking services are underrepresented.

From the very beginning, the attitude to the company's plans was ambiguous. So, governments, banks and regulators have expressed concerns that Libra will adversely affect the traditional financial system. In contrast, some blockchain technology enthusiasts thought that the new digital asset will stimulate the development of the cryptocurrency segment and positively affect the economy.

However, let's take it in order: and first, consider the most important aspects of the Libra project; and then why and how have Facebook plans changed.

- What is Libra

- Technologies of Libra Cryptocurrency

- Regulators and Governments

- Reorganization of the Libra Project

- Libra — not a cryptocurrency?

- Can Libra Be Bought

- Trust Issue

What is Libra

Libra is an ambitious project by Facebook, Inc. based on blockchain technology to create a digital analogue of the payment system mainly in those countries where the population is experiencing difficulties with banking services.

According to the plan, about 2 billion users will become active clients of the online translation platform. At the same time, the company's mobile networks, such as WhatsApp, Messenger and Instagram, will provide convenient access to in-country and transnational transactions around the world.

In an official document, Libra is presented as "a global currency and financial infrastructure that empowers billions of people."

The project initially included six main components or functions:

Later, due to pressure from regulators and authorities, Facebook made adjustments to the project.

In other words, Libra is no longer considered a single currency for all global transactions, but just one of the digital payment methods, in addition to which will also include, for example, the US dollar and the euro.

Official Libra website

History of Libra Cryptocurrency

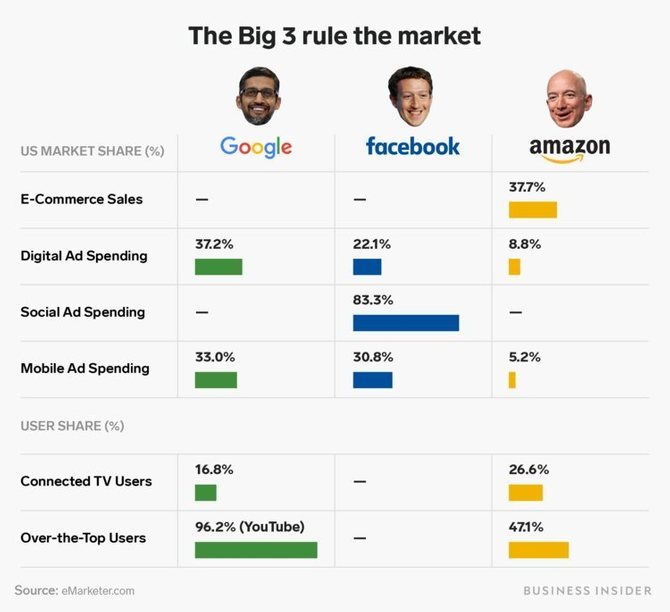

Facebook is one of the three corporations that dominate the US online economy. So, $ 2 of the $ 3 spent on digital advertising in the country goes to Facebook and two other IT giants — Google and Amazon.

For a profit-oriented corporation, it is only natural to look for ways to further grow it. And just the project of the global analogue of payments solves this problem well. In any case, analysts predict that the Libra cryptocurrency can become a huge source of income for the social network.

“One thing to keep in mind: Facebook’s annual revenue per user is about $ 50, but maybe a little more. The average bank generates about $ 1,000 per user, so Facebook has a 20-fold growth potential compared to banks if the company starts providing banking services. That is why I understand why banks are not really happy with this (project), ”said Tom Lee, an analyst with Fundstrat Global Advisors.

For the first time, Facebook was talked about the “home crypto” in May 2018, when the company began to show a remarkable interest in blockchain technology. Confirmed the information and the active hiring of blockchain specialists. However, at that time it was only about payments within the network. And finally, On May 17, 2019, Reuters announced an announcement on the registration in Switzerland of the fintech company Libra Networks, "specializing in blockchain, payments, data analysis and investment."And a month later — on June 18, Facebook officially presented Project Libra.

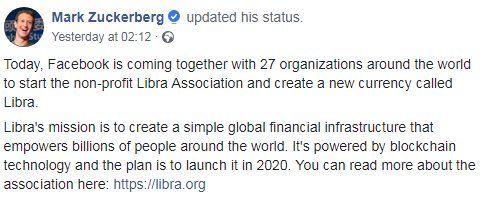

Mark Zuckerberg wrote on his page that day that the company, together with 27 organizations, had teamed up to create the new Libra cryptocurrency, which is scheduled for release in 2020. By design, Libra should be an alternative to cash, credit cards and bank transfers. Interestingly, in his rather lengthy message, Zuckerberg never called Libra cryptocurrency.

The head of Project Libra was David Marcus, former president of the electronic payment system PayPal. According to him, the Libra project will provide competition in the field of financial services.

Blockchain Libra

Today, most experts are confident that, in the event of a successful launch, the Libra currency from Facebook could become the largest in the world. Let's turn to the WhitePaper Libra, which talks about the coin and its test network.

The Libra cryptocurrency is built on the Libra Blockchain blockchain, which, as said, provides "security, scalability and reliability" of operations. The blockchain uses the Byzantine Fault Tolerant (BFT) consensus algorithm, based on the VMware HotStuff platform. Although BFT is characterized by high performance and fault tolerance in networks, it should be noted that this is a fairly new protocol, so far not widespread and not yet credible.

Each Libra cryptocurrency transaction is recorded on the blockchain into a cryptographic authenticated database that acts as a public online book. The platform processes 1000 operations per second. For comparison, the Bitcoin network (BTC) processes 7 transactions per second, and the Ethereum (ETH) blockchain processes 15. A prerequisite for this speed is 16 TB SSD hard drives and a connection with a bandwidth of at least 40 Mbps.

During a transaction, each node performs a calculation based on the register of all transactions. The Byzantine fault tolerance system (BFT) allows for consensus if at least ⅔ nodes have confirmed the legality of the operation. Only after this transaction is completed and recorded on the blockchain.

Features of the Libra blockchain:

- All Libra cryptocurrency transactions are recorded in a cryptographic authenticated database, acting as an open online book;

- Speed — 1,000 operations per second. For comparison: the Bitcoin network (BTC) processes 7 transactions per second, and the Ethereum blockchain (ETH) — 15. The prerequisite for performance is 16 TB SSD hard drives and a connection with a bandwidth of at least 40 Mbps;

- During a transaction, each node performs a calculation based on the register of all transactions.

Three important conditions:

- Transactions cannot be canceled. However, if more than ⅓ the validator node is compromised, the blocking will automatically block, and these transactions will be frozen until the block is removed;

- Users have to pay a small “gas” fee, such as on the Ethereum blockchain;

- These are pseudo-anonymous non-storage transactions: network members can see the transaction amount, timestamp, and public addresses.

Libra Blockchain is open source and licensed with Apache 2.0, i.e. enables third-party developers to create their applications in the new Move programming language.

Cryptocurrency Libra

Libra's mission is online payments. Being a stablecoin, the coin eliminates the wild volatility inherent in ordinary cryptocurrencies.

However, in February 2020, it became known that the Libra Association was exploring the possibility of changing the collateral model to a dollar one. In this way, the consortium hopes to dispel the negative attitude of authorities and regulators towards Libra as a potential threat to the dollar.

Every time someone cashes Libra, the equivalent value of coins is minted and issued. If money is withdrawn from the blockchain, then the equivalent in Libra is burned. This means that the value of a coin is always 100% secured by real reserve assets.

In the future, Libra will allow:

- Cash out a certain number of coins in the currency of the state where the user resides;

- Pay with coins for certain goods;

- Spend cryptocurrency in online services, etc.

Most experts are sure that if the cryptocurrency is successfully launched, Libra may become the most widespread in the world.

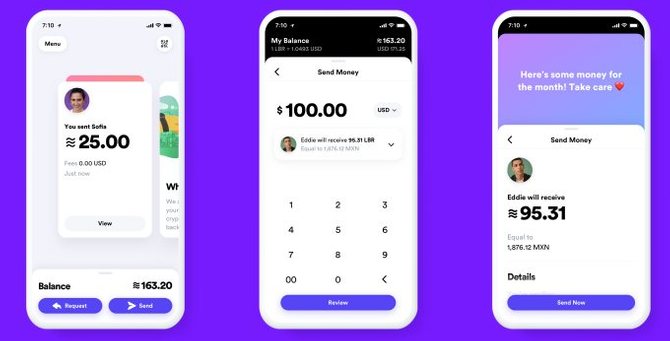

Calibra Wallet

After the release of Libra, users will be able to purchase crypto assets through the Calibra virtual wallet. For its development and management, Facebook opened a “daughter” of Calibra, registering it in the Financial Crimes Enforcement Network (FinCEN) — financial crime networks.

At the first registration, the application on iOS or Android will offer to go through the “Know Your Client” (KYC) identification procedure. During the verification, you will need to confirm your identity with a photo document. Only then will operations with Libra become available. The wallet will greatly simplify the use of the coin in the Facebook ecosystem.

With Calibra you can:

- Send cryptocurrency;

- Buy on Facebook, Instagram, WhatsApp and Messenger;

- Select the addressee of the transaction, the amount of coins sent and complete the description;

- Request an expedited payment method using a QR code.

The application will also indemnify you for hacking your account and remember complex crypto passwords.

Calibra will not make money at first, but Calibra's chief product manager, Kevin Vale, said monetization will take place later.

“Over time, we hope to offer additional services for people and enterprises, such as paying bills with the click of a button, buying a cup of coffee with a code scan or traveling on local public transport without having to carry cash or taking the subway, ”said Kevin Weil.

Libra Association

Numerous scandals related to Facebook’s inability to protect user data and privacy, led to the fact that the IT-corporation proposed to manage the project not itself, but the Libra Association. As the head of the project, Marcus, said, if the company itself controlled the blockchain, very few would want to "jump" onto the platform.

In this way, the social network “killed not two, but several birds with one stone”:

- Solved the problem of mistrust, which could prevent the mass adoption of the Libra currency;

- I took off the burden of sole responsibility, distributing among the members;

- Lowered the level of attention on the part of regulators conducting an investigation of the company's activities for breaches of confidentiality and anti-competitive behavior;

- Introduced instead of a decentralized supercentralized type of control. However, Facebook attributes its platform to a decentralized one, implying that it is a priori provided by members of the Association.

“It (the blockchain) is decentralized — it means that many different organizations manage the blockchain, and not just one.This makes the system fairer. ”

— Mark Zuckerberg explained his point of view.

Libra Association is registered in Switzerland.

Despite the stringent requirements, the list of the first members of the Association included 28 largest companies.

Market leaders such as Mastercard, PayPal, Stripe, Visa, Booking Holdings, eBay, Facebook / Calibra, Farfetch, Vodafone Group, Bison Trails, Coinbase, Andreessen Horowitz, Ribbit Capital and others announced their participation.

However, due to increased pressure on the project from the authorities and for fear of spoiling relations with financial regulators, a number of companies soon left the consortium. So, in October 2019, the six largest companies left — PayPal, Visa, Mastercard, Stripe, eBay, the travel company Booking Holdings and the online payment platform from Argentina, Mercado Libre, and in January — the payment service Vodafone. However, companies said they did not rule out the possibility of reinstating membership at a later stage.

Also in March of this year, one of the unpleasant surprises for Facebook was the decision of the few remaining participants to enter into an alliance with a rival stablecoin project known as Celo. Among them: Coinbase Ventures, Anchorage Mercy Corps, Andreessen Horowitz. Celo plans to use its service token to facilitate cross-border payments using a smartphone.

Technologies of Libra Cryptocurrency

LibraBFT Consensus Algorithm

LibraBFT — Libra consensus algorithm. Blockchain adopts Byzantine fault tolerance system — Byzantine Fault Tolerant (BFT), which is characterized by high performance and resistance to network failures. We add that this is a fairly new protocol in the field of cryptocurrencies, which is so far not widespread and has not yet received wide recognition.

The Byzantine fault tolerance system (BFT) allows for consensus if at least ⅔ nodes have confirmed the legality of the operation. Only after this transaction is completed and recorded on the blockchain.

The way BFT works is simple. A distributed system reaches consensus even if some nodes on the network become malicious. The ultimate goal of the mechanism is to protect against system failures. In LibraBFT, the nodes responsible for the production of blocks are called "validators."

Move Programming Language

Facebook engineers have developed a new functional programming language, Move, for executing transactions and smart contracts on the Libra blockchain.

Three Move assignments:

- Creation of cryptocurrencies, tokens and digital assets;

- Blockchain transaction processing;

- Validator management.

Regulators and Governments

Philip Herlin, Ph.D. in economics and author of two books on Bitcoin, once said about Libra:

"... it will be the first transnational currency."

Not surprisingly, Facebook’s plans to launch a blockchain-based payment system provoked strong dissatisfaction among governments, banks, and financial regulators. Not the least role is played by the scandalous reputation of the company, which too freely manages the databases of its customers, using it for marketing purposes.

There are known cases of leakage of personal information of users due to backdoors in the social network security system. But the biggest fear of the authorities is caused by the growing influence of the IT giant on the country's economy.

For example, US Senator Elizabeth Warren believes today's big tech monsters have too much power and prevent a new generation of IT companies from taking their rightful place in the industry. Therefore, to approve the new Facebook project, which will further increase the social and financial influence of the corporation, government officials have not yet decided.

And it's not just about the United States. The authorities of Great Britain, Germany, Italy, Canada, France, Japan harshly criticize the project and make decisions blocking the operation of the platform on its territory. So, according to the Minister of Finance of France Bruno Le Mer, the digital coin Libra cannot be considered as a replacement for fiat money. The minister suggested that the central banks of the G7 countries (Big Seven) carefully analyze the project. The parliamentarian from Germany Marcus Ferber, who is sure that Facebook may well become a “shadow bank”, has a similar position.

Regarding developing countries that have huge economic difficulties, the likelihood that Libra will become the accepted currency there still remains. In this case, the implications for the national economy of these countries cannot be predicted.

In the USA, the attitude towards Libra is even more complicated. Congress and regulators continue to research all the potential risks of the project. We can say that the country is tightening its financial policy. All questions are about how the functioning of the payment system complies with the legislation of the country and what impact it will have on the economy and stability of the dollar. He is interested in the authorities and how the corporation is going to maintain confidentiality and protection of user rights.

Mark Zuckerberg is trying to solve problems: answers Congressional questions, meets with central bank managers, constantly consults with the Treasury, the Securities and Exchange Commission (SEC), and the Commodity Futures Trading Commission (CFTC). But the results of meetings and negotiations were not reported in detail.

The goals of the alliance and the goals of governments can be far from the same. In general, there is something for the authors of the project to think about.

Reorganization of the Libra Project

The pressure of regulators and governments on the Libra project does not weaken and even intensifies. Zuckerberg does not intend to retreat, but he is well aware that a plan adjustment is needed.

“This is a very long game, and we need a starting point. Facebook spent too much money and a lot of resources to implement the initiative … They started very ambitiously, gradually reducing their intentions, "

— described the situation by Meltem Demiro, strategic director at digital asset management company CoinShares.

So what changes are made to the project?

In early March 2020, Facebook made an important decision to support other currencies, including those issued by central banks. Now Libra will not be the main means of payment, but one of the ways to conduct transactions.

In addition, the company is postponing the launch of its digital wallet Calibra for October 2020, which previously also had a central role in online payments. The wallet will support several currencies at once, and not just Libra.

Surely such a decision, as well as the accepted restrictions on wallet availability, will slow down the deployment of Calibra. However, the basic functions of storing and transferring money remain unchanged, both for Facebook Messenger and for WhatsApp. Only the dates are unknown.

So far, the company has not lost hope of launching a blockchain, but it is important for it to fit into the allotted framework. Time will tell how successfully the regulatory problem will be overcome.

Libra — not a cryptocurrency?

As Fund Lee’s analyst at Fundstrat Global Advisors rightly pointed out, the Libra project has confirmed the growing public interest in cryptocurrencies. However, many believe that Libra is more a fiat currency than a crypto asset. And there are many reasons for this opinion.

But this is one of the most key characteristics of cryptocurrency. And no matter what arguments Facebook puts forward, like 100 Libra Association members are enough to ensure decentralization, — fact remains — the coin is not decentralized. Moreover, Project Libra has many pitfalls, which work just against decentralization and the very idea of cryptocurrency.

According to Richard Dennis, founder of the Temtum cryptocurrency token, Libra contradicts everything a cryptocurrency should be. He believes that “no one should control the personal data and means of users”, and IT corporation, as practice has shown, is committed to this.

Also, a decentralized blockchain allows any user to run a node, even if it’s expensive. On the contrary, Libra nodes are launched only from the servers of the Association members — that is: Facebook, Uber, Paypal and others.

The fact that the platform will be managed by large corporations that seek to profit and strengthen their influence, creates a gap between cryptocurrencies and a new coin. For opposing purposes, a useful consensus is not possible. In other words, the Libra blockchain is not public, as is the case with Bitcoin or Ethereum — this is a consortium blockchain.

"Is Libra Facebook a real blockchain? No"

— noted one of the most respected experts on bitcoin and blockchain Andreas Antonopoulos .

So, Libra is much closer to building a digital bank and a centralized payment system than to creating a full-fledged cryptocurrency. In this regard, the statement of Facebook that everything will change in five years, and the Libra blockchain will become open, is extremely skeptical about the crypto community. Most likely, on the contrary, the coin will strengthen the power of one of the most powerful corporations in the world.

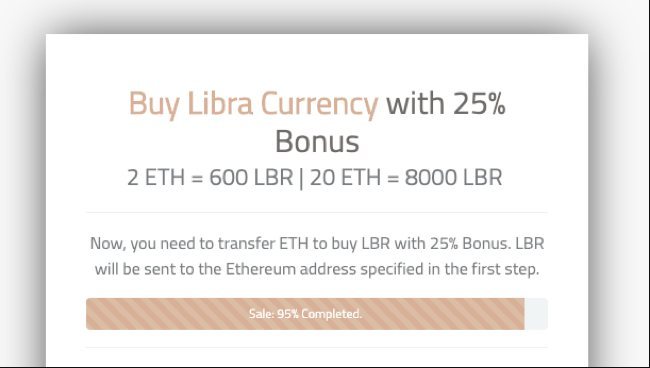

Can Libra Be Bought

With a strong desire — it is possible! And even get a good discount on a beautiful site. That's just bring Libra will not work. Ask — Why? Because it’s impossible to buy what is not yet. The launch of the coin is planned only for 2020.

In addition, before its release, Libra cryptocurrency must pass a mandatory security check. And only then will it become available to users for exchange, purchase and other things.

With low volatility, buying it sooner or later does not make much sense. You should buy Libra only when you need to use it. Probably, the price of the Libra against the dollar, if it fluctuates, is slightly. So, this is not a coin for speculation.

After the release, the Libra will be available, along with other coins, including fiat money through the Calibra digital wallet, which will allow you to get a coin to everyone who has a smartphone with the Messenger or WhatsApp installed.

With regards to cybercriminals, they began to buy domains immediately after June 18, 2019, when Facebook announced a future cryptocurrency. Scamers are trying to trick those who want to buy Libra on the Internet. Some have already been affected by scam.

So, in a report published by the Digital Shadows threat intelligence group last year, about 350 domains were discovered offering to buy Libra. These domains either pretended to be a legitimate website, or promoted a scam under their own names. According to Digital Shadow, the best sites are almost impossible to distinguish from legitimate ones.

Another report from The Washington Post claims that you can find many Libra offers on the social networks Facebook, Instagram, Twitter and YouTube. Various groups and communities position themselves as the “official” source of the new currency.

On them, users are invited to register or deposit their money in order to be the first to get their hands on a certain amount of Libra cryptocurrency: in the first case, it is about collecting personal data, in the second — about the theft of money.

There are also altruistic offers that guarantee the receipt of coins if the user visits several specific sites or, even worse, download and run the supposedly useful application — in fact, it could be malware infecting your device to steal personal data and passwords.

In response to an investigation by The Washington Post, a Facebook spokesman said:

“Facebook removes ads and pages that violate our rules when we find out about them, and we are constantly working to improve scam detection on our platforms.”

Ask — what to do? The answer is not to succumb to the "gold rush", and wait for the official launch of Libra, after which you can buy Libra.

Trust Issue

According to WhitePaper, Facebook will not import contacts or any other profile information from the social network to the payment network and, conversely, transaction information to the social network. The exception will be cases when the data will be necessary to study and evaluate the adoption of the currency, to combat fraudsters or at the request of law enforcement agencies … So it was promised in the document.

However, numerous violations of the confidentiality of users, their rights to privacy, providing third parties with access to databases — created the scandalous glory of Facebook, as a company unreliable, not able to ensure the security of trusted information.

As it turned out, the company itself uses the “Like” buttons to launch trackers and scripts that track users’s Internet visits, even when offline and outside of Facebook services. Simply put, a corporation collects the most detailed profiles of personal activity.

And it is unlikely that the company will abandon what gives it a competitive advantage both in social networks and in third-party advertising markets. Not so long ago, the US Federal Trade Commission (FTC) ordered Facebook to stop linking the data that it collects outside the network with social network user profiles.

The attitude of the management of the IT company to the problem is quite controversial. It seems that the company declares the confidentiality of its users and is responsible for it, but on the other side — privacy investigations are published again and again. So, corporate obligations (not just Facebook) to ensure confidentiality are often not fulfilled.

Users have every reason not to trust the company. If the corporation also monitors transactions, it will find out what people buy, how much and where they spend, their financial well-being and much more. With financial information about each client, payment system databases will become much more valuable and expensive.

Interesting is the opinion of Facebook co-founder Chris Hughes, who called the Libra cryptocurrency a success in the Financial Times on June 21. According to him, the new currency will transfer power from central banks to corporations.

The harsh pressure of regulators and authorities has somewhat changed the development vector of Libra. However, Facebook is preparing to launch the project, and time will tell does Libra really creates the necessary conditions for the development of a global payment system based on blockchain technology.

BitTorrent Cryptocurrency (BTT) — a Viable Project or Another Info Hype from Justin Sun