Stellar (XLM) is a blockchain platform for transferring digital assets worldwide. The purpose of the creation was to provide users with the ability to make payments quickly, cheaply and safely. It was launched as a competitor to Ripple in 2014 by one of the founders of XRP, Jed McCaleb. The Stellar platform token is Stellar Lumens (XLM).

In this article, we will consider in detail what tasks the cryptocurrency Stellar (Stellar Lumens) solves and what are its strengths.

- What is Stellar?

- Stellar Team

- Stellar Technology

- Stellar: Advantages and Disadvantages

- Stellar Partners

- Stellar Price and Capitalization

- Stellar Wallet

- Prospects for the Development of Stellar

What is Stellar?

The Stellar cryptocurrency is a rethinking of the Ripple platform by one of the founders of XRP by Jed McCaleb in 2014. He did not like that the Ripple project was not decentralized enough, and many aspects of its device did not meet his vision of blockchain technology. Unlike most cryptocurrencies that appeared later, the launch of the XLM token was not preceded by an ICO. At the very beginning, the development of the project was supported by Stripe, which invested $ 3 million in Stellar.

Initially, the Stellar cryptocurrency was implemented on the Ripple protocol, but in 2015 the platform switched to its own protocol, and the tokens were renamed to Lumens. Stellar code is publicly available and anyone can suggest changes to improve the platform.

Stellar Team

The Stellar Development Foundation was created in 2014 by Jed McCaleb and Joyce Kim as a nonprofit organization dedicated to the development of the Stellar open-source platform.

Patrick Collison, CEO of Stripe, also helped create the Development Foundation (SDF), the Stellar Foundation, in particular, he provided the young company with seed capital in the form of investments on behalf of Stripe.

The core team of the Stellar team includes the following specialists:

- Jed McCaleb (co-founder and lead developer) — at the beginning of his career created the resource eDonkey2000, which became one of the largest file hosting services. He also developed Mt. Gox, the first major Bitcoin exchanger, however, he sold it long before “accidents” began to occur with this site. After that, he became a co-founder of Ripple, which was created in 2011, but in 2013 left the project and began to develop Stellar;

- Nicholas Barry (CTO) — participated in the development of computer systems for Microsoft and Salesforce; Has a master's degree in computer science and mathematics;

- David Mazires (Principal Researcher) is a professor of computer science at Stanford University and head of the Secure Computer Systems research group. He is engaged in the study of operating systems and distributed systems with an emphasis on computer security.

Advisers to Stellar are: Patrick Collison (CEO of Stripe), Nawal Ravikant (founder of AngelList), Sam Altman (president of Y Combinator), Matt Mullenweg (creator of WordPress.com) and others.

Stellar Technology

Stellar Consensus Protocol (SCP)

Stellar was originally launched as a fork of Ripple, which uses a consensus mechanism based on the Byzantine Generals Task (BFT). However, a year after its launch, the project switched to its own protocol developed by David Mazier — the Stellar Consensus Protocol (SCP).

The platform's transition to SCP completely broke its connection with Ripple. In essence, the principle of operation of SCP and BFT is similar, but with the difference that in the latter, block validators are predefined by a company or organization (for example, Ripple Labs).

It takes two to five seconds to generate a block — that’s how much time it takes to reach consensus on the Stellar network.

The nodes in the SCP themselves determine which nodes they trust. Together, they form the so-called “quorum”, which, when a certain number of nodes are added to it, reaches a consensus.

SCP was designed as a more decentralized alternative to BFT, but for this, a high degree of security had to be sacrificed, since anyone can participate in the process of forming blocks.

Imagine this situation: an attacker creates a group of malicious nodes that attack a network. Given the small number of “decent” nodes, a hacker can do great harm to the network.

However, the SCP protocol has a defense mechanism in such cases: if one or a group of nodes behaves in an unnatural way, the network will “freeze” until a consensus is reached. This approach should protect Stellar from attacks, however, this happens at the cost of stopping the network for an indefinite time, which will negatively affect the efficiency of its operation.

In general, the process of forming and validating a block in the Stellar blockchain looks like this:

- An independent algorithm polls the active nodes of the network regarding the willingness to participate in the validation process.

- Transactions created by users are sent directly to active nodes for confirmation. This approach is a huge plus, since a pool of unconfirmed transactions is not created, as, for example, in the Bitcoin network.

- The nodes validate the transactions by checking in their copy of the blockchain records of completed XLM transactions from a specific address and determining whether it has the number of coins indicated in the transaction. This avoids “double spending”. After that, the node passes the transaction for validation to the next node. In order for a payment to be confirmed, it is required that at least 80% of the nodes reach a consensus. At the same time, they must have time to do this in a maximum of 5 seconds.

- The last validator that approved the transaction writes it to the ledger (blockchain), which is synchronized with copies of other nodes.

- Commission in XLM received from transactions is divided between the nodes that participated in the generation of the block.

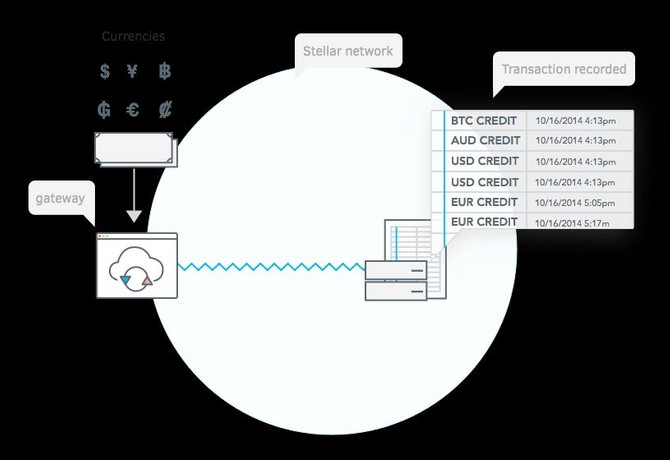

Anchor

To perform cross-currency transactions, Stellar uses the so-called “anchors”. They act as "intermediaries" that allow you to quickly exchange one currency for another with a minimum commission.

How it works:

- You have $ 100 you want to exchange for XLM.

- You go to your Stellar account, select the XLM anchor and deposit $ 100 into your account (for example, using a credit card).

- Your XLM account is now replenished with the amount XXXX XLM (and depending on the current rate).

This work scheme is relevant for any cryptocurrencies and fiat currencies supported by the Stellar platform. This is especially convenient when you need to transfer funds using cryptocurrencies to a country in which there is no access to money of the “new generation”.

The transactions are recorded in the ledger Stellar, a copy of which each full node of the network has.

Smart Сontracts

The Stellar cryptocurrency network allows you to create Dapps, launch ICOs and implement smart contracts. Unlike the popular Ethereum platform, which was originally created under “smart” contracts for EVM (Ethereum Virtual Machine), Stellar does not have such advanced technology for writing smart contracts, and the creators themselves note that the platform is only suitable for developing simple decentralized applications.

However, despite this, several Dapps were successfully launched on the Stellar blockchain, and companies conducted ICOs. Among the most famous are the following: Kin, Mobius, Smartlands, SureRemit, FairX.

Cryptocurrency Stellar (XLM)

Initially, the token was called Stellar, but in 2015 the company decided to rebrand, as a result of which the coin was renamed Lumens (XLM).

When sending a transaction, the user must pay a fixed fee of 0.00001 XLM. In addition, only a user can be a member of the network, on the balance of which contains the minimum XLM tokens set by the network. This ensures that all accounts intend to use the network, and protects it from creating empty spam accounts (wallets).

Stellar: Advantages and Disadvantages

Stellar was created as a powerful tool that should make cross-border payments available worldwide. Thanks to the combination of banking instruments taken from Ripple and its own decentralized protocol, Stellar has undeniable advantages:

But the disadvantages of Stellar are no less than the advantages:

Stellar Partners

Stellar cryptocurrency is a project with a serious reputation, which has won recognition not only in the crypto community, but also among ordinary companies. It is therefore not surprising that Stellar is paid attention as a partner. Here is some of them:

- IBM — Stellar Lumens (XML) coins will become the main currency for any payment programs developed by IBM. In addition, the computer giant uses XML for financial transactions;

- Stripe is a popular American payment service that makes money transfers affordable and fast. The services of the site are used by customers from more than 60 countries. An XML coin will be integrated into the service as one of the available currencies for transactions;

- KlickEx — the main goal is to solve problems with low liquid currencies in developing countries in which the banking sector cannot offer the proper quality of services;

- Remitr is a Canadian cross-border payment service. XML will be used to reduce the cost of international transactions;

- MSewa Software Solution (MSS) is a large payment system that offers services to customers from all over the world. Users can take advantage of mobile banking, even without a bank account. Users can take advantage of mobile banking, even without a bank account. Stellar Lumens will become one of the available currencies on the platform;

- PesaChoice is one of the most popular payment services among the African diaspora around the world. Allows cross-border payments with minimal fees;

- Keybase is a startup that has developed message encryption technology without using PGP keys. Users can create encrypted messages and even entire projects. At the same time, all keys are stored on the user's device, and Keybase does not have access to them. Stellar was one of the first Keybase investors.

Stellar Price and Capitalization

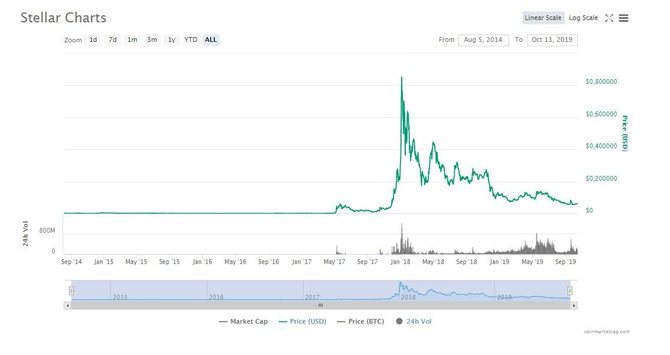

The Stellar cryptocurrency appeared on the exchanges in early August 2014. The initial price of the coin was only $ 0.002, and the market capitalization was about $ 768,000.

During the first three years, the price of XLM remained unchanged, however, in May 2017, the coin rate began to grow gradually, reaching $ 0.06. At the same time, capitalization amounted to over $ 490 million. Until the end of 2017, the value of the coin did not exceed this mark, the rate was stable without sharp ups and downs.

From the end of November 2017, Stellar began to grow rapidly. December 19 saw a sharp jump in XLM to $ 0.27 with a capitalization of $ 4.7 billion. This increase in value was due to the general hype on cryptocurrencies. In addition, during the same period, Stellar announced a partnership with IBM to conduct international transactions in real time.

On January 4, 2018, the exchange rate jumped sharply, reaching its record level of $ 0.89, and its capitalization amounted to almost $ 13 billion. This rapidly growing XML is associated with a peak in ICO investments. Placement on the Hong Kong exchange OKEx and partnership with the Pundi X platform also positively influenced the dynamics of the course.

In just a month, the price of XLM fell almost three times, dropping to $ 0.33, and market capitalization fell to $ 6.8 billion.

In 2018, Stellar was characterized by sharp fluctuations in the exchange rate. The ups of the course can be explained by the appearance of Stellar developer Jed McCaleb on the pages of the New York Times, which put him in the TOP 10 of the “revolutionaries” in the blockchain field.

Until April 2018, a downward trend was observed, then on April 29 the exchange rate hit $ 0.45 with a capitalization of $ 8.5 billion, after which the exchange rate continued to decline.

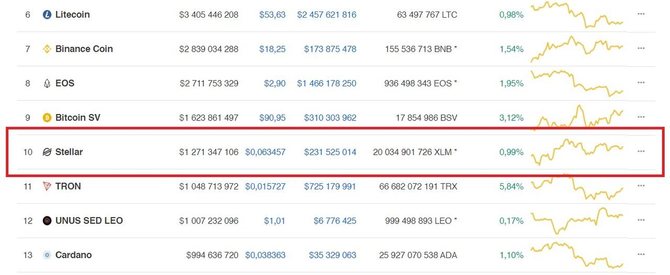

At the beginning of 2020, the Stellar price returned to $ 0.06, the coin capitalization is about $ 1.2 billion, so XLM takes 10th place in the CoinMarketCap rating.

Stellar Wallet

Before buying XML, you need to have a wallet for this coin: hardware, desktop or mobile.

In addition, Stellar has developed the official Stellar Desktop Client, which allows you to buy, sell, send and receive XML.

Also worth mentioning is the decentralized Stronghold exchange integrated into the Stellar system. If you don’t like hardware wallets or wallets inside the Stellar system, you should pay attention to Stargazer or Lobstr, which is perfect for both iOS and Android.

Prospects for the Development of Stellar

Cryptocurrency Stellar was created as a direct competitor to Ripple. However, compared to the latter, this cryptocurrency is truly decentralized, providing an opportunity for community members to participate in the life of the project. Also, one of the most important of the current advantages, which makes Stellar a promising service, is high liquidity.

We recommend you to watch an interesting video, what is the difference between Stellar and Ripple.

Cheap and fast payments in any currency is a service for which demand will only grow in the future, and Stellar cryptocurrency offers the perfect solution for this. In addition, the team is actively working on the development of the project and the introduction of new technologies. For example, at the end of September 2018, the launched decentralized exchange StellarX, which allows for the exchange with zero commissions, while providing a high level of liquidity.

Stellar is the first and so far the only company to offer such a solution. Also, the immediate plans of the project include the introduction of Lightning technology and the launch of the Stellar Lightning Network.

The capabilities of this cryptocurrency have already been appreciated by many companies, including large ones, such as, for example, IBM or Stripe, and the list of partners is constantly updated. Another important achievement of Stellar is that the company works not only with Europe and America, but also expands the scope of influence on other markets. So, in the middle of summer 2018, Stellar achieved certification of its blockchain by the Shariyah Review Bureau (SRB).

This means that the Stellar protocol complies with Sharia law, and now cryptocurrency can expand in markets that require products to comply with Islamic principles.

This is true, for example, for the Arab countries of the Persian country and some states of Southeast Asia.

However, despite all the advantages of this project, it has its drawbacks. We have already said that the Stellar project was created as a competitor to Ripple. Despite the fact that the Stellar cryptocurrency has significant advantages in the form of a decentralized protocol and serious partners, Ripple still has more of them because at this stage of development, it offers more advanced tools for the banking and financial sector. And, in addition, Ripple is a cryptocurrency whose capitalization is second only to Bitcoin and Ethereum.

If we consider Stellar as a cryptocurrency for ordinary users, then more popular coins, such as, for example, Dash or Bitcoin, are preferred. Dash - because the team is constantly developing new tools that simplify working with digital assets (for example, transferring funds via SMS in South America), and conducts active educational work among the population. Bitcoin is still the most popular coin and is an analogue of the words “cryptocurrency” and “blockchain” for people who are just discovering the crypto industry. But Stellar is not yet in the list of currencies for everyday payments.

We suggest watching the Stellar video review on YouTube:

Read also:

BitTorrent Cryptocurrency (BTT) — a Viable Project or Another Info Hype from Justin Sun