Maximal bitcoin led by Ton Weiss are sure that all altcoins will surely disappear and only one bitcoin will remain. But if you do not support this point of view, then our article is especially for you. In it, we will analyze Chris’s strategy from MM Crypto channel, how to make money on cryptocurrency during the altcoin season. Where he gives recommendations on when is the best time to sell Bitcoin and buy altcoins.

And in the second part of the article we will tell our opinion about this strategy and share expectations from 2020. Will there be X's, and if so, how and where to catch them.

Strategy

First, we will briefly review the video from the MM Crypto channel, which deals with making money during the altcoin season. Recommendation No. 1: buy while Bitcoin overcomes the historical maximum price. The last such best moment was in February 2017, when Bitcoin interrupted its historical maximum of $ 1,000.

As a result of this event, the interest of new investors arose in the market and they bought not only Bitcoin, but also the rest of the cryptocurrencies, which dragged their price up sharply. And as a result, the share of bitcoin in the market fell from 86% to 32% at the beginning of 2018, when bitcoin already passed its peak, and altcoins just reached the maximum price.

Tip # 2 is based on such a cunning indicator as Mayer Multiple, which according to the information of its creators should indicate a bear or bull market, as well as predict the inflation of a new price bubble. And also Chriss draws our attention to the fact that the real share of bitcoin in the market can be many times more, almost 90% or 95%. And the reason for this is obvious, because the vast majority of other cryptocurrencies on the market, Chris thinks so and we think so - this is just useless and unpromising garbage. And if we exclude them from the calculation, then the share of bitcoin will be at its historical maximums.

Now we look at the Mayer Multiple indicator and compare it with the graph of the bitcoin share - often this parameter is called domination. Additionally, we impose a 200-day moving average and it turns out that when Mayer Multiple is above this line, then this is the bitcoin season - it grows faster than other cryptocurrencies and its market share increases. And when the 200-day moving average is lower than the indicator, then the share of altcoins grows and this indicates the flow of capital to other cryptocurrencies.

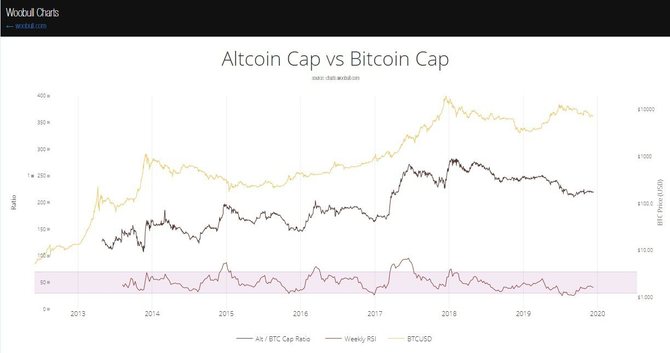

Now we already have two signs of the beginning of the altcoin season, but Chris just recently found another one and it is being built on this graph:

It combines the price of bitcoin, the ratio of capitalization of bitcoin and altcoins and the weekly RSI index. And as Chris shows and talks, altcoin growth begins while the RSI line goes below zero. But you need to look not only at this value, but also at the phase of the bitcoin market, because this rule does not work on a downtrend, and it does not work even when Bitcoin is simply at an early stage of the market cycle, as it was last year.

Conclusions

Despite our love for bitcoin, we do not consider ourselves bitcoin maximalists and we can well imagine a future in which other cryptocurrencies exist.

Regarding Chris’s strategy, a quick and superficial conclusion can be made, saying that he advised buying when Bitcoin will break through the maximum price - in this case, it’s $ 20,000. Also a recommendation to us, so it’s clear that after that a new people will break into the market, who will buy everything, what will see. And it’s even more profitable to buy in advance when bitcoin will only go to breaking the current maximum, because then the prices for altcoins will be even lower and you will get more profit.

However, the charts from Chris are worth a closer look, because in 2019 we already had one trick. Altcoins also grew along with bitcoin, but they did not come close to their peaks, moreover, only bitcoin showed good growth by the end of the year.

By the way, if according to Ethereum, Bitcoin Cash and Litecoin, the most profitable time to buy was still December 2018, then according to XRP it was December 2019 - it so happened that this moment had a double bottom. But this is the data at the time of writing, and if the price of bitcoin goes down to meet the 200-week moving average, then altcoins can again fall to the bottom or lower.

Consider this point if you are planning to invest in them and remember that you always need to do your own analysis and sometimes it’s better to buy more than stay out of the market when it flies to the moon.