The modern financial services market allows everyone to choose a reliable provider for online payments. Among them, leaders have long stood out, each of which is popular with certain categories of users.

One such service is the Payoneer payment system, which is mainly used by private entrepreneurs, freelancers and online sellers to receive and send international transfers, invoicing and currency conversions. Usually, this provider is chosen for its ease of use, support for many countries, low fees and, of course, the ability to order a debit card.

In this article, we will look at what the Payoneer service is, how to register and order a card, what are the tariffs in it.

- What is Payoneer

- Payoneer Registration

- How to Withdraw Money From Payoneer

- How to Deposit Payoneer

- Tariffs and Commission

- Payoneer Card

- Payoneer Reviews

What is Payoneer

Payoneer — is a popular international money transfer system licensed by the payment provider from MasterCard. Created in 2005. Developed through venture capital injections. It is included in the TOP-100 of the fastest growing financial companies. Payoneer is headquartered in New York (USA).

Today this system works with 4 million users from over 200 countries, enabling them not only to accept and send online payments in 150 different currencies, but also to use a proprietary debit card to withdraw cash from ATMs and settle through terminals at points of sale of goods and services.

Payoneer is also often found in the list of payment systems through which funds can be withdrawn from the balance of freelance exchanges like UpWork, marketplaces like Amazon and various web services for graphic content creators (for example, iStockPhoto).

Payoneer Official Website

Payoneer Registration

To register in the Payoneer payment system, you need to follow these steps:

- Go to the Payoneer website.

- Fill out the registration form.

- Wait for confirmation of the application for opening an account.

- Pass identity verification.

Despite the seeming simplicity of the listed steps, registration of an account in the Pioneer system should still be analyzed in more detail, since there are quite a few nuances in it.

First you need to visit the official website of this service, and using one of the buttons on the main page, start the registration process.

Then you need to specify which category the account you open will belong to:

- Freelancer, marketing network partner or digital currency producer (miner);

- Online seller;

- Service provider or manufacturing company.

Next, you need to confirm the correctness of the choice of the type of account by clicking on the "Register" button, under which there will be a list of received opportunities.

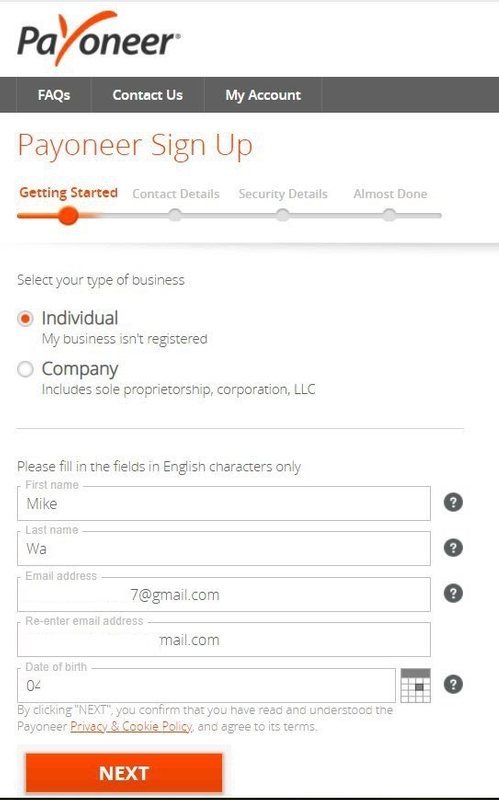

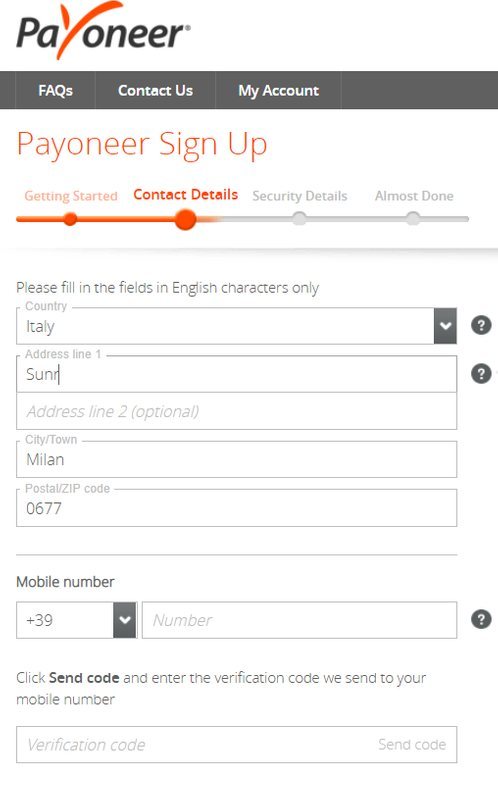

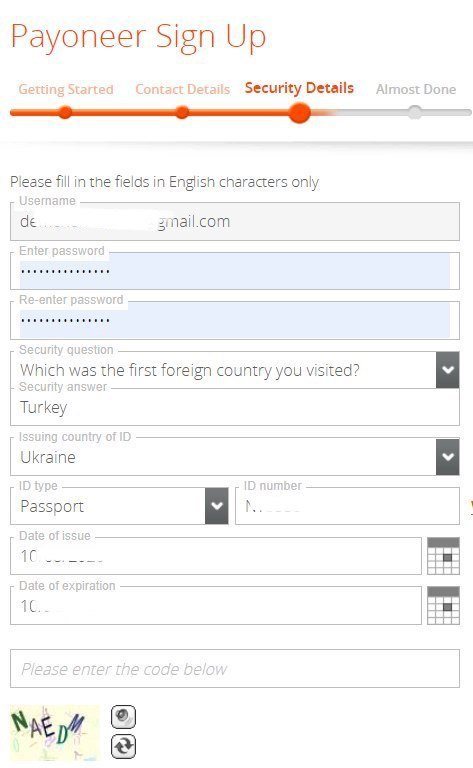

The registration form consists of four parts, each of which must be filled in with different types of data:

- Registration start — here you need to select the type of account for a private person (if you are not creating it for a company), as well as enter your first name, last name and email address.

- Contact information — the address of residence and the mobile phone number are indicated, which must be confirmed with the code from the SMS.

- Security details — you need to specify a password, a secret question and an answer to it, the type and number of the identity card, as well as the first and last name in the national language.

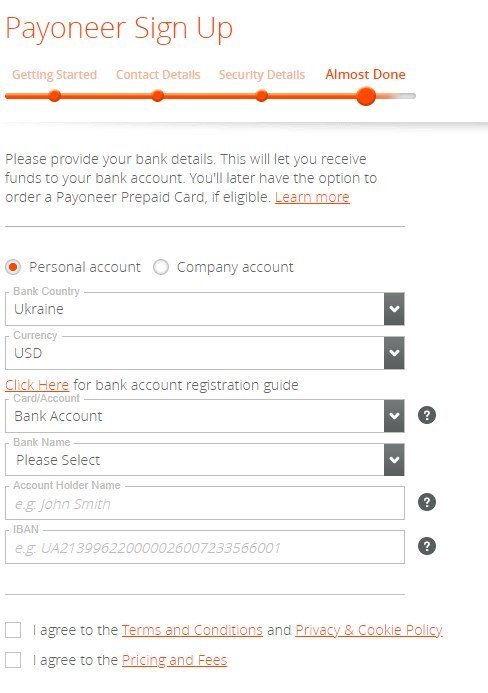

- Almost done — here you enter the necessary bank data (currency, bank name, card number and name of its owner) and consent to the provision of services in accordance with the Terms and Conditions, Privacy Policy and Payoneer's Tariffs.

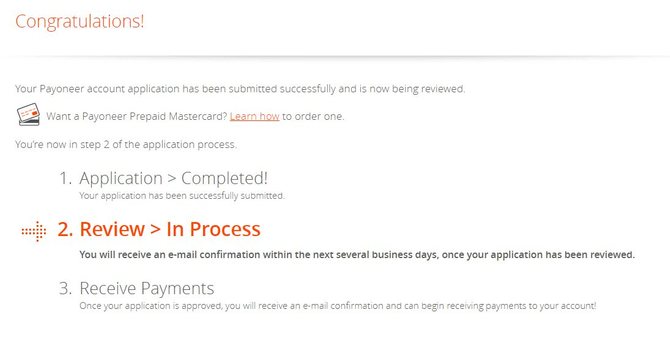

After completing the registration form, you will see a notification that your application is pending.

Most often, confirmation of opening an account occurs within a few hours from the moment of registration, but it is officially reported that this can take up to three business days.

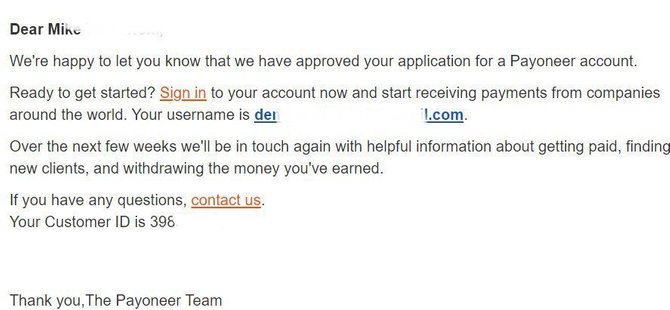

Next, it remains to wait for an email to come to your mail, which will indicate that your Payoneer account is approved and you can start receiving and sending payments (if the application is rejected, the letter will indicate the reason for the rejection).

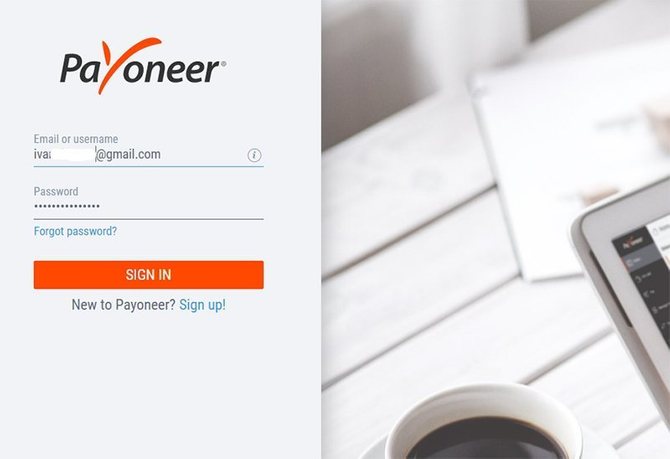

Immediately after that, you can log in to the Payoneer system (the "Login" button in the website header) using the email address and password specified during registration.

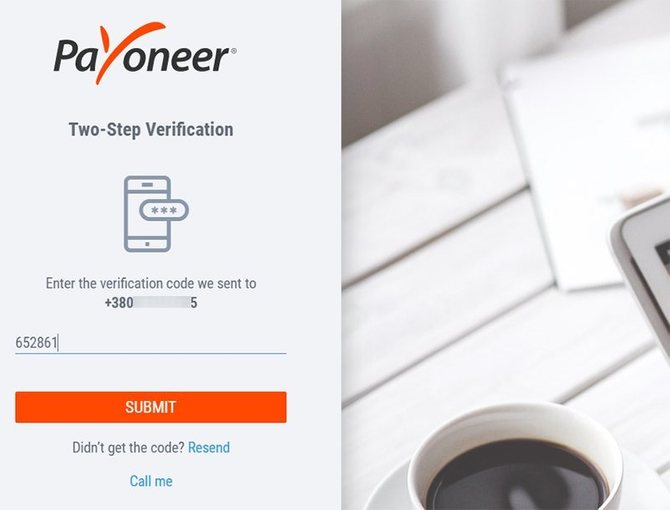

The first time you sign in to your Payoneer account, you will be prompted to enable 2FA (Two-Factor Authentication) to enhance your security. To do this, an SMS will be sent to your phone number with a confirmation code for this action.

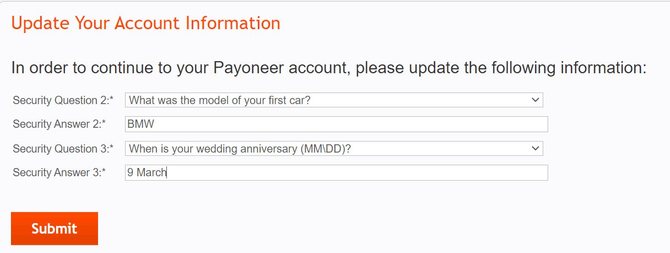

Then you will be informed that further registration of the invoice you need to indicate two more secret questions (the first was at the stage of filling out the registration form), for example, the city of birth of the mother and the date of the wedding anniversary.

After that, you will finally see your account on the Payoneer website for the first time, but account registration has not been completed yet.

A notification about this will be located above the block with balances of the main currencies of the cabinet.

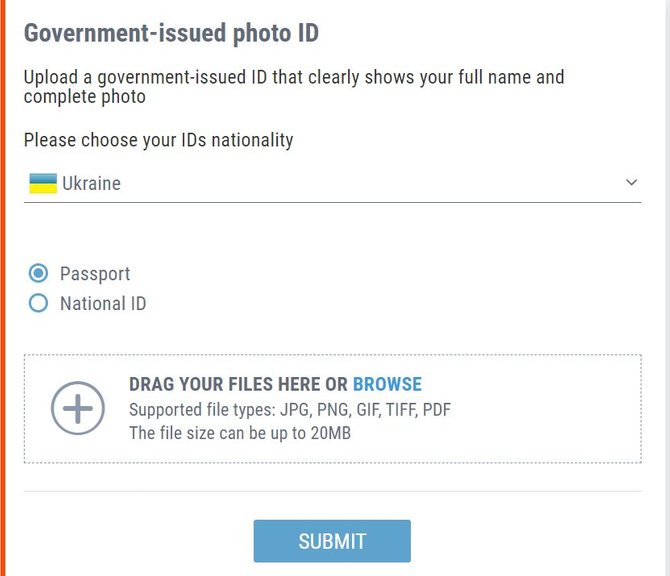

This process is very simple — you just need to select your country and type of document, and then upload its scans.

Next, it remains to wait for a letter confirming identity verification. This completes the process of registering an account with Payoneer — you can directly send money to other system users and accept payments from them to your balance.

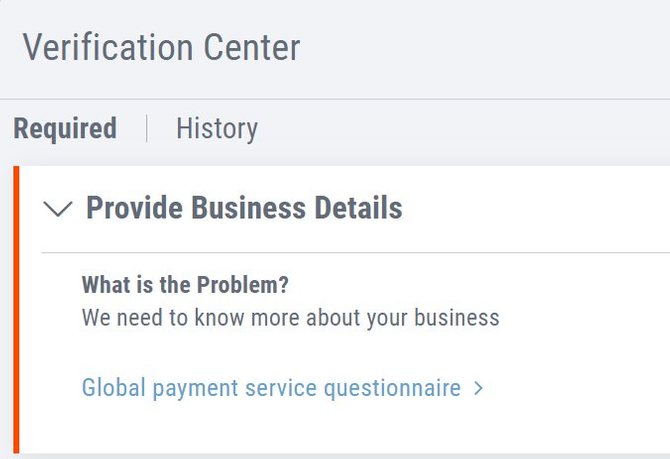

In most cases, this is quite enough for individuals. But if you need to receive funds through the "Request for payment" function (something like invoicing for the performed service), you will have to inform the Payoneer Verification Center additional data regarding the direction of your activity.

The same must be done if you are going to use the "Global Payments Service" — a service that allows you to get your own international bank details for accepting payments from companies from all over the world.

How to Withdraw Money From Payoneer

How to withdraw money from Payoneer:

- Go to the withdrawal menu to a bank account.

- Select the currency you want to withdraw.

- Specify data for withdrawal of funds.

- Confirm the operation.

If we consider this process in more detail, then there are two options for withdrawing money from the site of the Pioneer payment system.

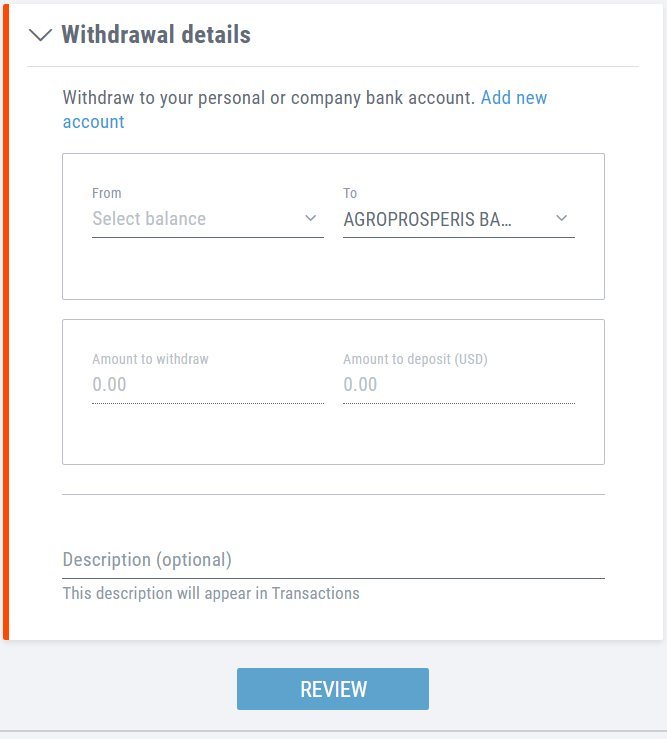

The simplest one is to a bank card that was specified during account registration. In this case, you need to select the "To a bank account" item in the "Withdraw" menu and click on the currency account from which you want to withdraw money.

In the opened form for creating a withdrawal request, the default bank card will already be displayed, so you only need to specify the amount and comment on the payment (optional).

After viewing the details of the output, it remains to confirm the operation and wait for it to be processed by the system.

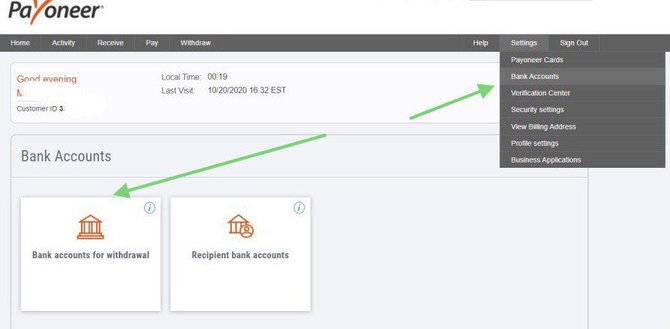

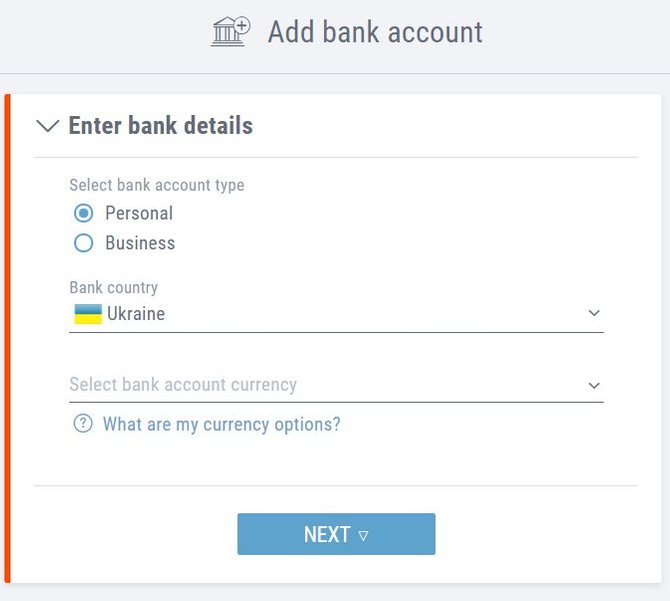

The second option for withdrawing money from the Payoneer website is to an alternative bank account. To do this, you must first add new details in your account through the "Settings / Bank Accounts" menu. Besides the default map, you can add two more.

The process of adding a new account itself is no different from the one that was at the registration stage — you need to select a currency, enter and confirm the card details.

After that, funds from the balance of the Payoneer account can be withdrawn to the added card according to the same scheme that was described above. The only difference is that now, at the stage of specifying data for withdrawal, you will need to select a new account instead of the one displayed by default.

To do this, you must first order it, taking into account how much its maintenance will cost, and what the withdrawal fees will be (for more details, see the corresponding section below).

How to Deposit Payoneer

Therefore, you can deposit the balance in this payment system only in the following ways:

- Receive payment from any other Payoneer user or system partner who is your employer.

- Request payment through the function of the same name on the website.

- Receive payment to your account through the Global Payment Service.

- Withdraw funds from a freelance exchange, Amazon or any other web service that supports Payoneer.

If you still have an urgent need to deposit your Payoneer balance, you can go for some tricks. For example, transfer money through any other payment system to a Pioneer user who agrees to make a payment to your account.

Also, in some cases, it is possible to deposit a Payoneer debit card through the load.payoneer.com service. As a rule, such an opportunity may appear after the account receives several payments by the main methods described above.

Tariffs and Commission

In addition, some of the services of this system are generally free, namely, opening an account, crediting transfers to the balance (all currencies except the dollar), payments to other Payoneer users, maintaining an account (without an issued card), paying by card on the Internet and in land-based stores.

Payoneer's current list of fees is as follows:

- 1% - for dollar transfers through the Global Payment Service;

- 0.5% - for converting funds between internal account accounts;

- 3% - for receiving funds through the "Request for payment";

- 2% - for withdrawal to a bank account;

- $ 3.15 - for cashing out at ATMs (plus 3.5% commission for currency conversion and the percentage charged by the bank);

- $ 1 - for checking the balance of the Pioneer card at an ATM.

More details about commissions can be found in the Help / Tariffs menu in your account on the website.

Payoneer Card

The Payoneer card is a regular personalized MasterCard, to which the account balance in any currency supported by the system can be linked. Its release and delivery is free, but you will have to pay $ 29.95 annually for maintenance.

Capabilities

With the help of a debit card, Pioneer users can spend money on purchases in offline and online stores, as well as withdraw money from ATMs. Three such cards can be ordered, one for each of the currencies — euro, dollar, British pound.

Funds credited to the user's Payoneer account balance are automatically credited to the debit card linked to it within 24 hours.

At the same time, no more than $ 5000 can be credited to the card within 24 hours. You can also spend from it no more than $ 5,000 per day — $ 2,500 for purchases and the same amount for cashing out at ATMs.

How to Order a Payoneer Card

How to order a Payoneer card:

- Fulfill the conditions for the possibility of ordering a card.

- Go to the debit card order menu.

- Fill out the application form for the card issue.

Immediately after creating and verifying your Payoneer account, there is no opportunity to order a card in it. If you go to the "Settings / Payoneer Cards" menu, you can see that there is a condition after which you can place an order - receive payments in the amount of at least $ 30, and these cannot be transfers from other users.

In the form that opens, you need to specify only two parameters — the card currency and the delivery address.

After clicking the "Order" button, a page will open where you can monitor the status of the application processing. The approximate delivery time of the card to the specified address is also displayed there.

If necessary, this process can be accelerated by contacting Pioneer support with a request to send the card by courier service DHL. In this case, the delivery time will be reduced to 3-5 days, but it will cost you $ 40.

Payoneer Reviews

Given the level of popularity of Payoneer in the world, it is not at all surprising that you can find a lot of reviews about this payment system. Naturally, there are both positive and negative among them.

Among the comments of dissatisfied customers, from time to time, there are stories of account blocking for no reason and Payoneer refusal to explain these actions.

Also, the support of this payment system is often scolded for failing to fulfill its obligations to customers in urgent situations. For example, when you need help solving a problem with an ATM that has withdrawn funds from a Payoneer card balance, but did not dispense them. If you look at the positive reviews about Payoneer, they mainly mention the ease of registration, the convenience of receiving transfers from abroad and the ability to pay in online stores.

There are also those who believe that Payoneer has high commissions, but this is compensated by the presence of a convenient application for mobile and payment cards.

At the same time, you can find reviews of customers with a serious experience of using this payment system, which refute the above-described shortcomings with statements like "level support" and "percentages are lower than PayPal."

There are also reviews of a neutral plan — which say that the service works well, but at the same time it is significantly inferior to its competitors in terms of communicating information to customers about limits and commissions for using services.

In general, we can say that despite occasional situations with account blocking and poor support work (if these are not paid reviews of competitors), Payoneer today is one of the leaders in the payment system market, which you can trust with your money.

Advcash — Wallet, Login, Registration and Advanced Cash Reviews